It’s been a long haul, but we finally closed on our land! We began our contract to own land on August 4th 2017 under a 60 day contract. Making a close date of October 3rd 2017. Instead, we closed Aug 14th 2018. However, we did not really fund till Thursday the 16th. I’m not sure how it’s possible but the bank refused to release the escrow to everyone until a few more papers were signed. Somehow, we got the land without anyone being paid, for two whole days! This is not how anyone should ever buy a home.

This whole process made me feel similar to how I felt after running my first marathon. After going through a year of extensions and frustrations in buying a raw piece of land.

Just sit for minute and let me tell you right now, about how my finances got turned upside down

For anyone wanting to know I’d like to explain how this loan works. I could not find much information on the internet about how it operates. There are a couple articles:

https://www.fha.com/fha_article?id=1002

https://www.fha.com/fha_article?id=1184

The company that financed my loan talks about their product as well:

https://www.afrwholesale.com/fha-one-time-close/

But this doesn’t get into the nitty gritty of how this loan operates. I would only recommend this loan if it is your only option. And even then, only if you know the ins and outs of it well. I’ll use my own loan as an example. I’ll alter the prices, but you’ll get the jist of it.

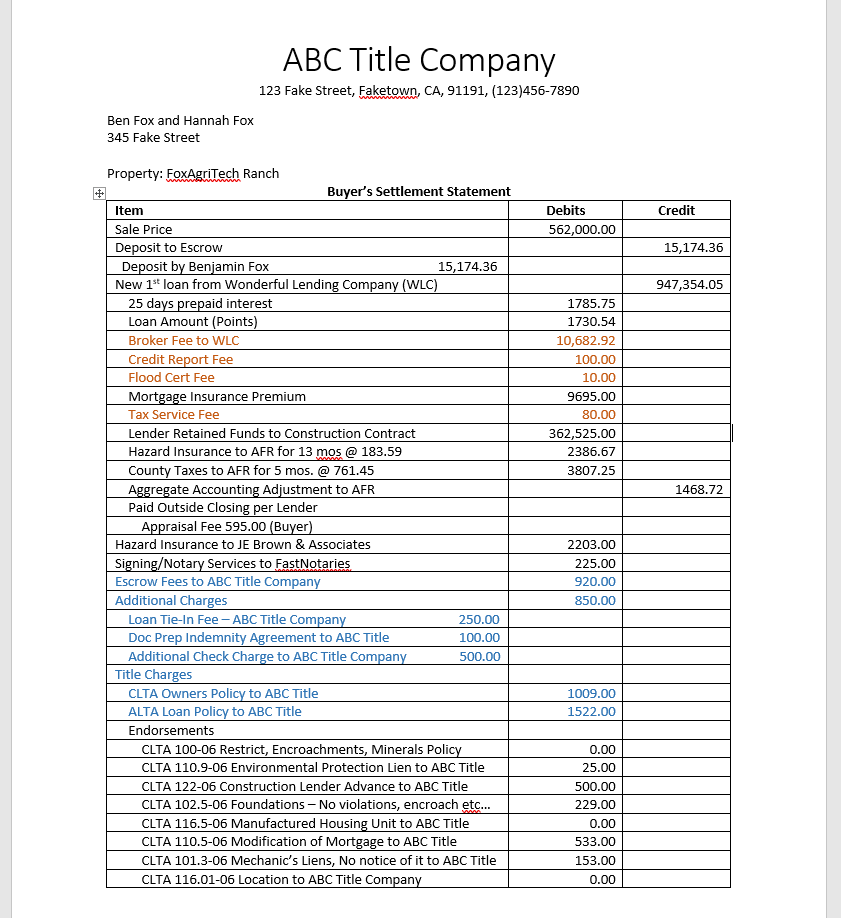

Here’s my breakdown and understanding of everything:

- Sales Price = Price of Land

- Deposit to Escrow = My Down payment

- New 1st loan = the loan I am getting to cover the costs of everything

- 25 days of prepaid interest

- Loan amount (Points): I’m paying more for a lower interest (because this took over a year!!!!)

- Broker Fees to ABC Company: My brokers paycheck.

- Credit Reporting Fee

- Flood Certification Fee

- Mortgage Insurance Premium: Up-front PMI payments to give time for the home to be constructed

- Tax Service Fee: I don’t know this one

- Lender Retained Funds to construct with DEF Company: How much the improvements and the home will cost together

- Hazard Insurance to ABC for 13 Months

- County Property Taxes to AFR for 5 months

- Aggregate Accounting Adjustment to AFR = I don’t know this one

- Appraisal Fee: I had to pay this before the loan

- Hazard Insurance to GHI Company = I don’t know this one, twice hazard insurance?

- Signing/Notary services $225 = Things were running so late with this thing (It was already over a year) that we had only one day to sign and get it back to our escrow officer who was 100 miles away. To solve that, someone came to my house, had us sign papers and then personally overnighted it. I thought it was free at first, And it was free, but then cost me…

- Escrow fees to Crow Company: This is my escrow officers paycheck

- Additional Charges: Odds and ends, and 500 for some Check Charge so that’s fun

- Endorsements:

- Not sure what any of these are I would guess It’s just the cost of doing business… I guess

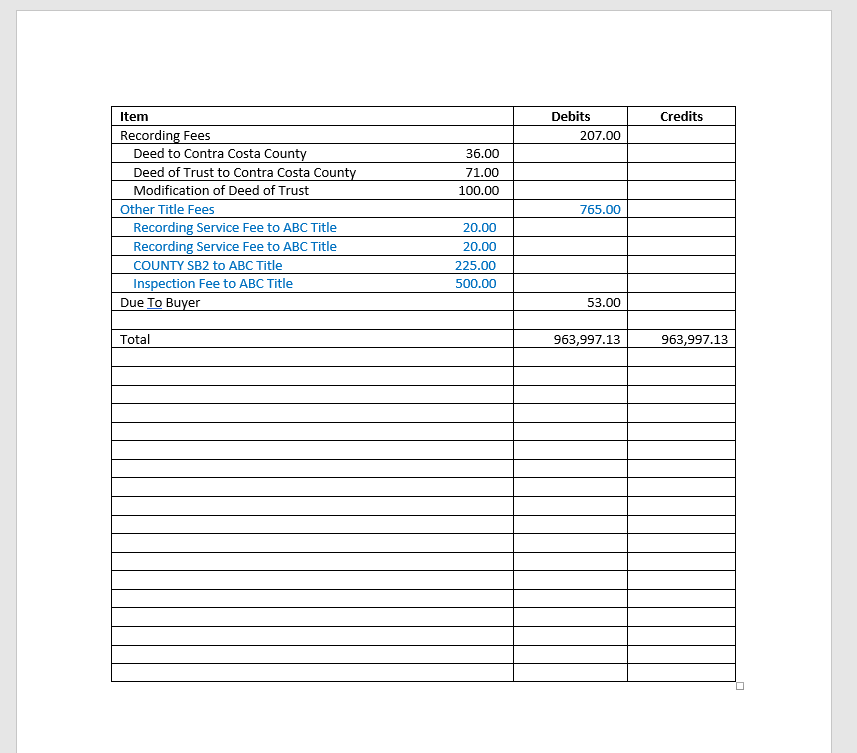

- Recording fees: These make sense and aren’t that much. It’s nice something makes sense and isn’t crazy expensive

- Other title fees:

- More inspections/Fees that seem to cost too much and don’t make much sense. WLC’s paycheck some more.

I’m a bit jaded with this WLC so I wanted to make sure that people know all the costs associated with going this route and to double check their broker and lending company. Their total fees that I do not understand or seem unnecessary seem about $12,110 (marked in Orange) and the Escrow company took roughly $2000 (marked in blue) in fees that do not make much sense to me.

A total of $14,000 that I let slip through my hands without even knowing why. This isn’t even including the 1500 in points I paid to keep a better interest like there was at the start of this loan. Or the cost of the home going up because of the fires in California. The longer this took, the more expensive it got. And I wasn’t making more money.

This shows how poor of a financial decision this was since there are so many things that I did not understand going in to it. Honestly, I didn’t think this was going to go through, so my preparations were a little slow in the end.

Learnings (hopefully)!

This a blog post to help others avoid the pitfalls that I fell into. Here are my three takeaways form this experience.

- Stay involved. As you prepare and work towards a home/land of your dreams, no one is going to have your best interests in mind but you. Some agents are fantastic, but they are still not you. Only you know what you want, let it be heard.

- Ask questions. There are so many moving pieces in a land or home transaction. Would you pay your mechanic a 1000 dollars to fix your car and not ask what he’s going to do to fix it. You’re not a mechanic, but you want to know where your money is going. This transaction is hundreds of thousands of dollars. You should be prepared to ask hundreds of questions.

- If it’s meant to be, it’ll be. Things go sideways sometimes. Not everything is meant to be, and those things that are don’t happen the way we dream them up. Be prepared to not get things how when or for how much you wanted. But… be prepared to make your happy ending in whatever way that ending comes.

As a spiritual leader taught me “Come what may, and love it!”

Leave A Comment